Think Buying a Home for $850K Is Out of Reach? Think Again – Here’s the Real Breakdown

Date 5 Sep 2025

For many Kiwis, the idea of buying a home feels out of reach. Rising house prices, tighter lending rules, and higher living costs often leave first-home buyers feeling like ownership is something only for “later.”

But what if we told you that with the right numbers, the right plan, and the right support, a brand-new home could be closer than you think?

Let’s take a real example: a brand-new 3-bedroom townhouse priced at $850,000.

Breaking Down the Numbers

- Deposit required (5%): Just $42,500, which could come straight from your KiwiSaver or personal savings.

- Income bracket: Most banks look for a combined income of around $130,000 to $140,000, depending on other financial commitments.

- Mortgage repayments: With major banks currently offering a 12-month fixed rate around 4.79%, plus a 0.75% Low Equity Margin, your weekly repayments over 30 years would be approximately $1,062.

That figure might surprise you.

For many households, those repayments are on par with, or in some cases less than, what’s already being paid in rent. The difference? You’re building ownership in an asset that grows in value over time.

Your Investment Could Grow – A Lot

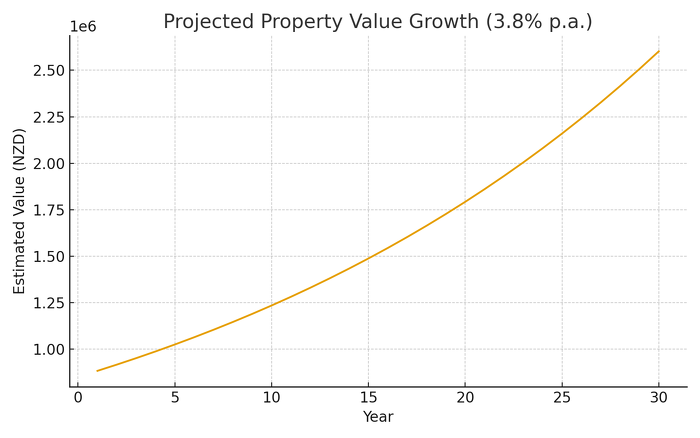

Property is more than just a place to live – it’s an investment in your future. Even at a conservative growth rate of 3.8% to 4% per year, that $850,000 home could be worth $2.6 to $2.8 million in 30 years.

This projection isn’t pulled from thin air. Analysts from Opes Partners, point to steady long-term growth in Auckland’s property market. While the days of double-digit annual rises may be behind us, sustained growth at around 3 – 4% remains realistic.

That growth represents far more than a number on paper. It’s long-term wealth, security for your future, and something you can pass down to your children. In other words, it’s your legacy.

How The Mortgage Hub Makes It Possible

Buying a home involves more than saving a deposit. It’s about strategy, structure, and support – and that’s where The Mortgage Hub comes in. We:

- Run the numbers for your unique situation – giving you clear, pressure-free advice.

- Explore eligibility and funding strategies – like using KiwiSaver or looking at First Home Loan options.

- Compare across multiple lenders – so you’re not limited to one bank’s offer.

- Structure your loan so repayments fit your lifestyle, not the other way around.

- Guide you step-by-step from pre-approval through to settlement, handling the details so you can focus on your new home.

Our mission is simple: to make homeownership achievable, less stressful, and more rewarding.

Let’s Do the Math Together

If you’ve ever thought, “I’ll never be able to afford a home in Auckland,” it’s time to take another look. With the right planning, smart lending strategies, and professional support, what feels out of reach might be much closer than you think.

At The Mortgage Hub, we believe in straight-up, honest advice. No jargon, no pressure – just clarity about your options and what’s possible.

Message us today, and we’ll run the numbers for your situation.

Check out the video here for a quick overview of how we can help and why buying smarter starts with good advice.

What else is happening in the market?

A snapshot of current articles relating to the housing market, interest rates, most popular areas to buy in and common trends relating to the property world in New Zealand.