Market Update: What the OCR Cut Means for Borrowers

Date 21 Aug 2025

The Reserve Bank of New Zealand has reduced the Official Cash Rate (OCR) by 0.25%,

taking it down from 3.25% to 3.0%. This move was widely expected, and it

comes at a time when households and businesses continue to face cost pressures.

For borrowers, though, the immediate effect is clear: mortgage rates are coming

down, and affordability is improving.

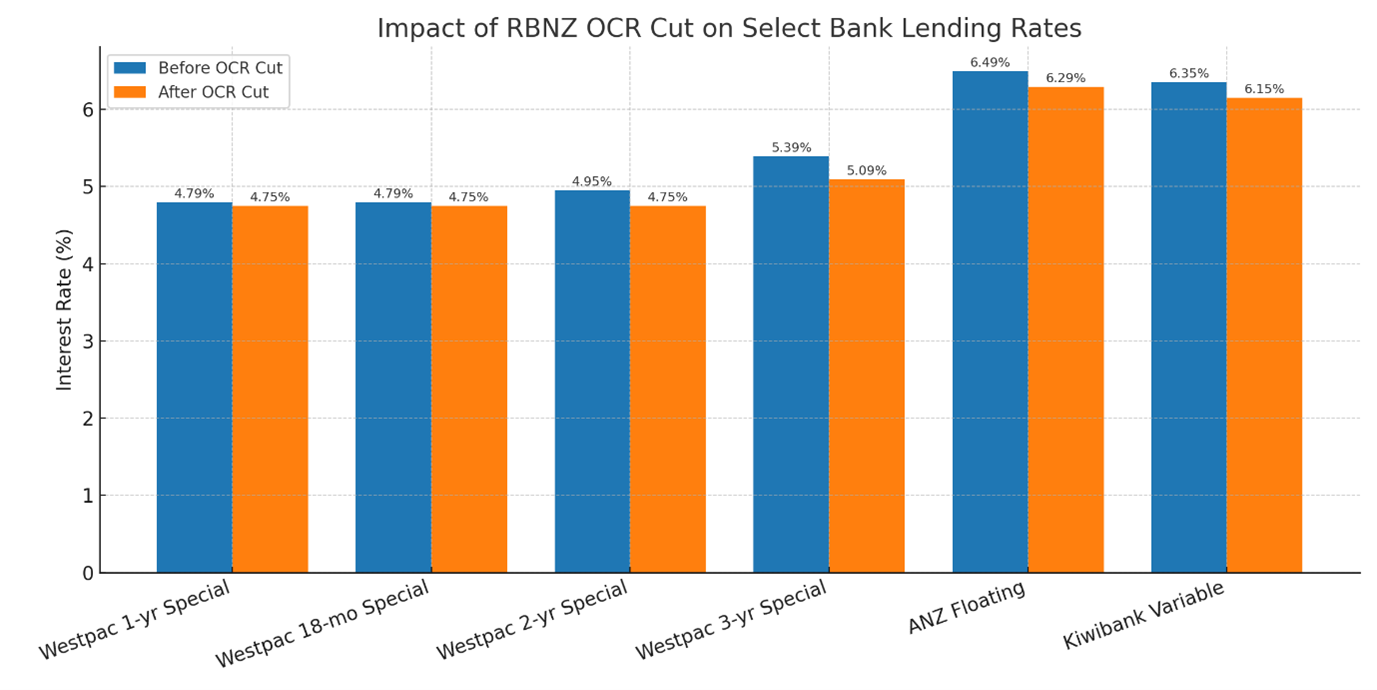

Already, major banks have responded. Westpac, ANZ, and Kiwibank have announced

cuts across both fixed-term and floating mortgage rates. Westpac’s one-year,

18-month, and two-year fixed specials now sit at 4.75%, the lowest in

the market, while ANZ’s floating rate has dropped to 6.29%. Kiwibank has

eased its variable home loan to 6.15%. For context, one-year mortgage

rates across the big four were sitting around 4.79% just weeks ago.

How Banks are Passing on the OCR Cut

The chart below shows how lending rates at the major banks have shifted since the Reserve Bank’s announcement.

Data from Thursday, 21 August 2025

These reductions highlight how quickly banks are responding to the OCR cut, providing more attractive fixed-term options for borrowers.

Why This Matters for Borrowers

Mortgage repayments are one of the largest household expenses, and even small shifts in rates can have a significant impact. A 0.25% reduction in interest translates to thousands of dollars saved over the life of a loan, or in practical terms, hundreds of dollars less each month for many families

For example,on an $800,000 loan, a 0.25% drop in rates could save around $2,000 a year in interest payments. That kind of relief can ease the pressure of higher

living costs, and for those looking to buy, it can mean the difference between

borrowing approval or being left on the sidelines.

Banks are also signalling greater flexibility in lending. With lower rates and slightly relaxed thresholds, borrowers who previously fell just outside of servicing criteria may now find themselves in a stronger position to secure finance.

Market Dynamics: Signs of a Turning Point

While affordability is improving, the property market itself remains in transition.

According to the latest Onehub report:

- Property search activity is up 23% year-on-year, with 16.2 million searches in July.

- The average expected sale value sits at $998k, down 1% compared to the same month last year.

- Listings fell to 3,488 in July, with average days on market at 76.

This paints a picture of a buyer’s market – plenty of choice, soft price growth, and motivated vendors. But as borrowing becomes more accessible, buyer confidence

is expected to return, and demand will gradually pick up. When that happens,

price momentum will likely follow.

A Window of Opportunity

The latest OCR cut is widely viewed as the first of several, with the Reserve Bank hinting at further easing ahead. Across the Tasman, the Reserve Bank of Australia

recently cut its OCR to 3.6%, reinforcing the trend toward regional monetary loosening.

For borrowers, this means two key things:

1. Borrowing costs are falling now. Repayments are lighter, and banks are more open to lending.

2. The market balance will shift. As more buyers come back,competition for property will increase, and affordability gains could be quickly offset by higher prices.

In other words, there’s a window of opportunity – rates are lower, approvals are more attainable, and prices haven’t yet started to climb.

Our Role at The Mortgage Hub

In today’s changing market, having the right lending strategy is just as important as the interest rate itself. The choice between fixing or floating, opting for short or long terms, or splitting your loan across multiple structures can make a

significant difference to both your monthly cash flow and your long-term financial outcomes.

At The Mortgage Hub, our role is to guide you through these decisions:

- Structuring your loan to align with your personal goals and financial situation.

- Navigating lender policies to give you the best chance of approval.

- Comparing multiple banks and lenders so you get competitive options and flexibility.

- With interest rates moving and lending conditions shifting, the right advice and

structure can be the<

The Bottom Line

The OCR cut has created a more favourable environment for borrowers. Rates are easing, affordability is improving, and lending criteria are loosening. But as market confidence returns, buyer demand is expected to strengthen, and prices may

begin to rise again.

For households and investors alike, the opportunity lies in acting during this

transitional phase – while borrowing conditions are improving but before

competitive pressures push property values higher.

Mortgage brokers play a key role in helping clients navigate this shift, ensuring loans are structured to maximise both affordability and long-term flexibility. With

more change expected in the months ahead, now is the time for borrowers to explore their options and make informed decisions.

What else is happening in the market?

A snapshot of current articles relating to the housing market, interest rates, most popular areas to buy in and common trends relating to the property world in New Zealand.